Why is it that many sustainable food brands are not so successful?

Better to have a brand that fits perfectly with a small target group than one that fits a little bit with everyone. An article on the necessity of choosing the right target audience for sustainable food brands.

(previously published in Dutch on Marketingfacts.nl)

When asked to name a sustainable Dutch food brand, everyone immediately shouts Tony’s Chocolonely. But what comes next? Name a sustainable food brand that is truly successful and truly sustainable? More difficult than it seems. Naming an A-brands is already difficult. But if we look at the many start-ups in the food world, it is (unfortunately) a battlefield. A targeted, segmented approach to the right target group could well be the key to success.

Choosing the right target audience

After all, a one-size-fits-all marketing approach is not effective for something as personal as food. Because in a fragmented landscape, it’s hard to stand out. But by focusing on a specific audience, you as a brand can offer unique products and experiences for that specific audience. This differentiation aspect not only increases brand visibility, but also helps build loyalty with consumers within that specific segment. So rather a brand that fits perfectly with a small target group than one that fits a little bit with everyone. By choosing the audience with the highest potential and targeting only that audience, with a targeted media mix and message, you can use your resources most effectively and efficiently. And by understanding the specific characteristics and interests of a particular segment, brands can develop campaigns that better resonate with that audience. Whether they are health-conscious consumers, vegetarians, or lovers of international cuisines, tailoring marketing content to the specific needs of each segment increases the likelihood of a positive response.

Why generic segmentations don’t work

But how do you choose the right target audience? This is not an easy question to answer. The easy way is to choose a target group based on demographic characteristics such as age, gender, income and location. But consumers within the same demographic group can differ significantly in their tastes, preferences and buying habits. For example, we see time and again that differences between generations are smaller than differences within a generation. Within Generation Z, we find both do-gooders and convenience seekers. So focusing on a particular generation or “families with children” is still too generic, because there are major differences between them in the way they look at food.

And then there are existing classifications of consumers into lifestyles or based on general values and life views. But these are often not specific enough for food marketing. In fact, a really useful segmentation for food marketing is based on the socio-cultural dimension of food and the influence of the food environment on the choices the Dutch make. Incidentally, this applies to every category. A really useful segmentation is based on category-specific attitudes and behaviors In other words, you have to look for groups of people who look at your category in the same way and not group them based on how they see the world.

The limited importance of sustainability

We find the answer to the question from the title in the new Food Profiles segmentation. Namely, far from everyone considers sustainability as important in their food choices. In other words, many sustainable food brands are not successful because they are too sustainable. Affordability is currently the most common consideration for Dutch consumers when making food choices, followed closely by enjoyment and convenience. These are aspects that benefit consumers in the short term. Aspects that provide longer-term benefits such as health and sustainability are less relevant at this time. But so what consumers in each profile consider important varies greatly.

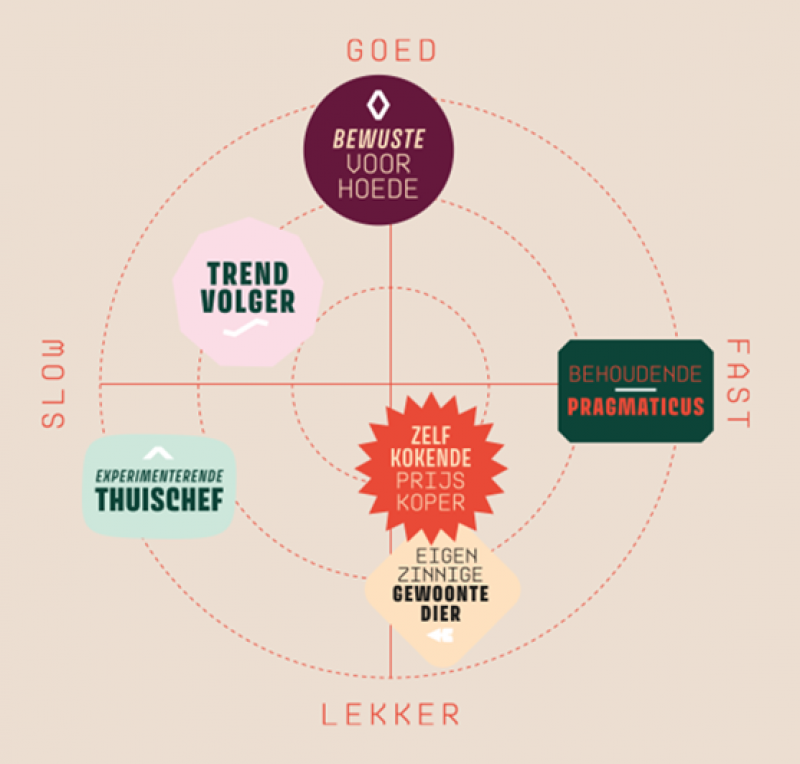

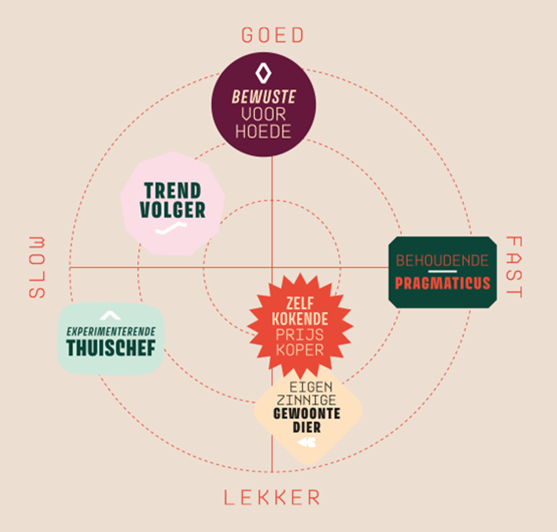

The picture below shows the six profiles on two axes. The horizontal axis shows how much time, money and effort consumers are willing to invest in their food. On the far left we find the Experimental Home Chef (14% of the Dutch), who goes for quality enjoyment. His opposite is the Conservative Pragmatist (22%), who is primarily guided by affordability and convenience.

The vertical axis shows whether a consumer is more likely to go for the tasty, or the conscious choice. At the top is the Conscious Vanguard (18%), the group most interested in sustainability. At the bottom we find the Quirky Creature of Habit (14%), a group critical of innovation.

A sustainable proposition thus only reaches a limited part of the Netherlands (as the election results showed). The bottom of the model seems to offer more opportunities for (new) propositions. Where as a sustainable brand you will have to position yourself based on other characteristics than being better for the world.

A food-specific segmentation model

The Food Profiles model was developed by Food Cabinet, creative agency for good food, and Future of Food Institute, market research firm for sustainable consumer behavior. The six Food Profiles give marketers, brand managers and food entrepreneurs insight into relevant target groups to determine which of these are most relevant to their product or organization.

The model is a classification of consumers based on differences in attitudes toward six themes: sustainability, enjoyment, convenience, affordability, trendiness and health. These themes emerged from an extensive literature review, combined with years of experience of both agencies with consumer behavior and food choices. Through a large-scale quantitative survey (n = 1,200) among consumers, the distinctive profiles were identified. Additional qualitative research was used to further color the Food Profiles.

Want to know more? On the website foodprofiles.nl you can download a white paper with a detailed description of the segments.

Join our workshop on May 29th or June 26th!

In 2 hours, we will show you how to get started with Food Profiles effectively.

What to expect? We will explain the 6 profiles, so you will be even better able to analyse which USPs of your brand, product or service are appealing to which profiles. We will literally give you a look behind the scenes of these target groups, based on the qualitative research we carried out, including photographs of the contents of refrigerators and kitchen cupboards. We will also tell you more about the possibilities of using Food Profiles to put your target group(s) in an even better light. And last but not least, you get to know your personal Food Profile, so that from now on you are aware of any bias towards a particular target group.

The workshop will take place either in Utrecht or Amsterdam from 2p.m. to 4p.m.

If you can’t make it, there will be more dates coming up later this year.

You can sign up here.

We believe that understanding consumers is key to making the food system more sustainable. Successful innovation and impactful communication require a solid foundation of consumer insight.

We are the insights partner of choice for food companies and non-profits that aim to have a positive impact on society and our planet. Together we empower consumers to make food choices that are good for them as well as for the planet.

The Hague Tech - Wilhelmina van Pruisenweg 35 - 2595AN - The Hague

(+31) (0)70 2042314 - Info@futureoffood.institute

Contact

Fill in this form and we'll be in touch shortly!

Newsletter

Do you want to receive a monthly dose of insights, opinions and events? Please subscribe to our newsletter.